Ramp Time for Sales: Your Guide to Accelerating Productivity

Business stakeholders care about increasing their sales pipeline with more deals, larger deals, shorter deal cycles, and higher close rates. Each of these is a complex web of systems and people, which makes it hard to identify the levers that matter.

One well-accepted lever that has downstream effects on each of those major goals is ramp time.

Ramp time, within the sales domain, refers to the period a new sales representative requires to reach full productivity—this encompasses onboarding, training, and experiencing a complete sales cycle. It’s a critical metric because it directly influences a company’s capacity to expand its sales pipeline effectively.

Here’s why ramp time is so significant:

- Sales Pipeline Growth: Shorter ramp times mean new reps contribute to the pipeline faster, increasing the number of active sales engagements.

- Deal Size: Experienced reps are more adept at understanding customer needs, which can lead to securing larger deals.

- Sales Cycle Efficiency: Proficient reps can navigate the sales process more effectively, potentially shortening sales cycles through better qualification and closing techniques.

- Close Rates: As reps become fully productive quicker, they’re likely to close deals at a higher rate due to improved sales skills and product knowledge.

- Financial Planning: Accurate ramp time is crucial for forecasting revenue and aligning sales rep hiring with revenue goals.

- Strategic Decision-Making: Understanding ramp times allows sales leaders to make informed decisions on when to extend training or initiate sales coaching.

It’s been observed that the average sales rep ramp is a company’s normal sales cycle plus three months. Businesses that can improve this metric often see tangible benefits across all aspects of their sales performance.

Current ramp times can cost companies up to three times the employee’s base salary. The time needed to get a new sales hire up and running can account for up to 5% in annual revenue losses.

Components Contributing to Ramp Time

In general, the time it takes a new sales rep to ramp up to full productivity depends on their Quality, Experience with the Product, and Experience with the Market. Let’s start with Quality.

Quality — The Combination of Tenure and Skills

Quality can be thought of as a combination of tenure and skills:

Tenure: A nuanced view takes into account not just the years spent in the industry but also the depth of experience in relevant roles and the salesperson’s history within the company. It’s enhanced by the breadth of their professional network. However, tenure’s true value shines through the lens of success—measured by pivotal metrics such as Quota Attainment, Customer Retention Rate (CRR), and Sales Cycle Time.

These indicators show how effectively a salesperson has applied their tenure in practical terms.

Skills: While tenure is a static attribute once a salesperson is hired, skills are dynamic and can be cultivated. They encompass a range of competencies from the art of questioning and listening to the technical mastery of product expertise and understanding the nuances of the sales cycle.

Skills are actionable levers in reducing ramp-up time and enhancing sales effectiveness.

Cost Considerations

The higher quality a rep is, the more expensive they’ll be, although it’s likelier they’ll have a lower ramp time.

One method to decrease costs associated with ramp time is to decrease ramp time. Another is to enable lower-quality (cheaper) reps to ramp as quickly as higher-quality (more expensive) reps.

Compensation Breakdown

Salary: Fixed cost. Reducing total salary costs through a tool like Nayak saving new hire salaries during extended ramp periods would directly increase profits.

Commission: Variable cost tied to salesperson productivity. Shortening ramp time accelerates when a rep starts closing deals and earning commission income, enhancing overall contribution margin.

Experience with Product

A rep’s experience with a product is a combination of familiarity, training, prior knowledge, and strategic product insights.

Let’s break this down:

Familiarity: Sales reps need to be well-versed in the product through case studies that illustrate the product’s real-world success, detailed marketing content, and messaging that clearly communicates the product’s value proposition. The effectiveness of familiarity is contingent upon easy access to these resources.

Training and Prior Knowledge: While formal training is standard in many organizations, its long-term efficacy is often limited by the natural tendency to forget learned information over time. In contrast, experiential learning — learning that occurs within the flow of work — tends to have a much higher retention rate. Prior knowledge, often tied to tenure, is a static variable post-hire, yet it forms a significant part of a rep’s initial ability to understand and sell the product.

Strategic Product Insight:

- Business Impact Analysis: Beyond product features, top salespeople understand and articulate the financial impact of solving the customer’s problem with the product, framing it as a critical and strategic investment for the buyer.

- Product Vision Contribution/Feedback: Richard Feynman said, “What I cannot create, I do not understand.” Contributing to a product’s roadmap allows salespeople to have a role in its creation, and is therefore the highest level of mastery a salesperson can have in understanding the product they are selling.

Experience with Market

Knowledge of the market comes down to understanding the space – the competitors, the partners, the news, the trends, and the customers.

- Competitor Knowledge helps a salesperson understand the landscape they are operating in and how to differentiate their offerings.

- Complementary Technologies provide context for integration and expansion opportunities that could be leveraged in sales discussions.

- Industry News is vital for strategic agility and ensuring that the sales strategy is aligned with external factors that influence buyers.

- Market Trends inform the long-term sales approach and product development, helping to anticipate future customer needs and market shifts.

- Customer Insights ensure that sales efforts are customer-centric, improving engagement and conversion rates.

Ramp Time Benchmarks

The Average Duration of Ramp Time

Ramp time varies on the complexity of the product and the sales cycle, and is therefore contingent on a company’s average sales cycle length.

The overall average ramp time for all B2B salespeople is the average sales cycle + 90 days.

Costs Associated with Ramp Time

Direct Costs

Xactly puts the estimated cost of a seller’s ramp time at 3x their base salary. This comes down to a mix of salary investment and training, development, and tools.

- Salary Investment: During a salesperson’s ramp time, they are still drawing a salary. If it takes a seller 6 months to fully ramp, they have incurred 6 months salary as a cost – potentially without closing a single deal.

- Training, Development, and Tools: Many sales organizations have a formal training program for new sales hires. These often take place at an in-person offsite, such as a hotel, and involve a lot of time and resources, including a lot of manhours from in-house leadership.

Other costs associated with training and development include an ongoing cost of sales enablement, sales operations, and, for the organizations that have it, ongoing training time. While a seller is ramping, they have access to the tools, support, and resources of fully-ramped reps while making minimal direct contributions to bottom-line revenue.

Indirect Costs

The opportunity cost

The opportunity cost of an extended sales ramp time can be substantial in terms of lost revenue potential. We can estimate this impact with a hypothetical scenario.

Imagine a case where the following is true:

– Average deal size for a rep: $25,000

– Average number of deals per month for a ramped rep: 4

– Average ramp time: 6 months

In this scenario, the company is missing out on $600,000 in potential deals due to that rep not being fully productive during their ramp period. This lost revenue could fund additional headcount, be invested back into the business, or simply contribute straight to the bottom line.

The costs extend beyond just one rep as well. If the company needs to hire 5 new sales reps in a quarter to meet growth goals, a lengthy 6 month ramp time means they won’t reach their intended revenue target until a full year after making those hires.

Accelerating ramp time directly translates to achieving revenue goals sooner.

Team Disruption

Integrating a new sales hire onto an existing team can hamper short term productivity:

- Training/shadowing time: Experienced reps must spend time training instead of selling.

- Limited capacity: Managers have finite time for 1:1 coaching/monitoring.

- Sales complexity: Introducing a new dynamic can disrupt established customer relationships.

- Opportunity ownership: Sales territories/accounts may need to be shifted or shared.

These can have a tangible impact on metrics for current team members in the form of:

- Lower sales activity volume (calls/meetings made, demos given, etc)

- Fewer new opportunities created during training period

- Potential decline in short-term conversion rates or win rates

While these impacts tend to be short-term and are often unavoidable, the downstream costs could include missed quotas for current reps or the inability to capitalize quickly enough on time-sensitive market opportunities.

Consequences of Extended Ramp Time

Reduced Productivity: Individual

During the ramp period, a new sales rep’s productivity in terms of hard metrics like calls made, deals closed, and revenue generated will be lower compared to their output once fully ramped. Factors contributing to this include:

- Learning curve with sales methodology, tools, CRM

- Building pipeline and establishing customer relationships

- Limited product knowledge and inability to effectively position value prop

- No existing book of business to generate rapid sales

As a result, their activity metrics, sales velocity, and commission earnings will be substantially lower over the first 3-6 months. This reduced individual productivity translates to an extended waiting period before the rep can positively contribute to team and company goals.

Reduced Productivity: Team

An incoming rep being ramped can indirectly disrupt the productivity of other established team members in a few key ways:

- Manager time diverted from existing team to train and coach new hire

- Shadowing by new rep takes time away from current reps doing regular sales activities

- Potential decline in response times or customer service levels

- Additional ramping support duties assigned to high performers on the team

As a result, key performance metrics across the team could be impacted over a quarter or two, including:

- Average sales cycle length increasing

- Win rates decreasing

- Total calls and meetings completed declining

- Fewer new opportunities created

- Lower total closed revenue

This highlights the need to have a ramp process that integrates new reps seamlessly without materially impacting the established high-performance culture.

The key things to monitor are activity volume, cycle times, and conversion rates across the team before and after onboarding new sales hires.

Delayed Return on Investment (ROI)

Time to Profitability

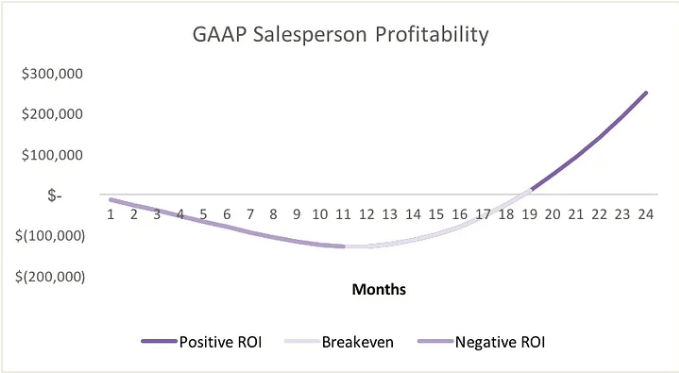

Even after a rep is fully-ramped, they will likely not deliver a positive ROI to the business. That’s because of factors like sales cycle length, months to contract start, average deal size, churn rate, and cost of goods sold.

Harry O’Sullivan and Paul Bianco of ffVC wrote an article titled ‘A Data-Driven Approach to Investing Salespeople’ outlining how long it takes salespeople to become a profit-driver for businesses.

Their assumptions are outlined here:

- Salesperson Ramp-up: 6 months

- Annual Bookings Quota: $1,000,000

- Sales Cycle: 60 days

- Average Contract Size: $20,000

- Months to Contract Start: 4

- Contract Length: 12 months

- Annual Churn: 10%

Using these assumptions, a salesperson is a cost-driver from month one to month 11, a break-even on cost from months 12 to 19, and ROI positive from month 19 onward.

Many business leaders falsely assume that an increase in the number of salespeople lead to an increase in revenue, whereas in most cases, for between 12-18 months after a salesperson is hired, they are in fact a cost driver and not a revenue driver for the business.

Financial Implications

Hiring additional sales reps represents a major investment for any business in terms of hard costs like salary, benefits, expenses, and training as well as opportunity cost. During the extended 12-18 month period where newly hired reps are driving net negative ROI, this creates significant financial strain in a few key ways:

Cash Flow Issues

With no offsetting revenue being generated by new reps to cover their costs for over a year, hiring them requires either drawing down on cash reserves or seeking additional financing to fund operating losses. Most early stage companies have limited cash runways, so this exacerbates burn rate concerns.

Deferred Growth Initiatives

Since the incremental hiring puts negative pressure on cash flows, companies may be forced to forego or delay other growth plans and investments in order to divert budgets to fund the rep – slowing overall progress.

Equity Dilution Risk

If the cash strain requires raising additional capital before the reps generate positive returns, further equity dilution results. This represents a permanent non-revenue cost of hiring and delays potential value accretion for existing shareholders.

Loss of Risk Tolerance

Carrying operating losses for over a year can tap available funding reserves intended as buffers against other major business risks. This tightens margins for error across the company.

In essence, the over 12 month delayed ROI from new sales hires acts as a financial drag by exacerbating burn rates, restricting investment capacity, increasing dilution, and reducing risk tolerance.

Minimizing this lag time is key to sound financial planning and executing growth.

Lost Sales & Market Share

When reps are still new and ramping up, they cannot capitalize on opportunities as quickly due to insufficient product knowledge, smaller networks, and lack of sales experience. This causes:

- Longer sales cycles from lack of credibility with prospects

- Lower win rates due to ineffective pitches or proposals

- Smaller average deal sizes from inadequate needs assessments

As a result, the company loses out on potential sales. Additionally, competitors with tenured reps can more effectively capitalize on opportunities and gain market share during this window of advantage.

Each quarter a rep isn’t fully ramped represents missed market opportunities that competitors can seize instead. The downstream effect is losing footing in key accounts or verticals which is difficult to regain once established. This can permanently depress market share.

Customer Perception

Early interactions with prospects when reps are new or still training leaves a less polished impression. This may negatively impact customer perceptions if reps seem:

- Overly scripted instead of consultative

- Unable to answer technical questions

- To push unwanted products vs solutions

Once ramped, reps better understand buyer needs and tailor pitches accordingly through consultative discovery. But negative early interactions could linger and hurt customer confidence.

If customers get a poor first impression of a company’s sales team, it makes it far harder to build authority and trust – even after reps improve. The cost of recovering from early missteps with accounts is high. An experienced sales team signals competence and quality to buyers.

How to Improve Ramp Time

Start with in-workflow learning — Learning in the flow of work (LIFOW) is a concept that emphasizes the importance of integrating learning into everyday work activities. Traditional training sessions — picture a multi-day offsite at a hotel with learning sessions modeled on standard classroom practices — yield only 10% knowledge retention. LIFOW can bring knowledge retention up to 90%.

Some tools to help improve Ramp Time

- AI-powered sales coaching tools like Nayak – Provide real-time guidance and feedback during customer calls to improve skills on-the-job. Microlearning modules reinforce best practices.

- Sales analytics platforms – Dashboards from Clari, InsightSquared, and Gong track individual and team metrics to identify skill gaps needing coaching. Managers can course-correct faster.

- Learning management systems – Platforms like MindTickle, Brainshark, and PandaDoc centralize training content and guide reinforced learning to boost retention.

- Sales methodology training – Shortened bootcamp-style sales training, microlearning content, and virtual workshops ensure methodology sticks. Combining with tools drives adoption.

The key is embedding ongoing training and enablement tightly within the normal sales workflow for accelerated skill development. Blending cutting-edge tools, AI guidance, and shortened structured learning forms a powerful stack to slash ramp times.

The Revenue Impact of Improving Ramp Time

Reduced Training Costs

- Traditional multi-week training programs cost thousands per rep in materials, facilities, and lost sales time. Tools that embed learning in daily work simplify skill building.

- Ongoing sales methodology and product training takes a fraction of the time compared to offline workshops. Reps learn as they work.

- Less time spent in training means reps start selling and earning revenue faster.

Decreased Turnover Costs

- With LIFOW practices in place, junior reps are set up for success, avoiding frustration that leads to turnover.

- Replacing a salaried sales rep costs between 1-2x their annual salary from lost sales time, recruiting fees, training.

- Decreasing turnover from 30% to 15% could save hundreds of thousands in turnover costs annually.

- Higher job satisfaction improves sales culture and customer service.

LIFOW can dramatically reduce onboarding costs while enabling scaled hiring at lower salaries, potentially cutting sales team costs by 50% or more.

Revenue Implications

Quicker Revenue Generation

With a shortened ramp-up time, salespeople can start contributing to revenue sooner, which improves cash flow and could potentially lead to a faster growth trajectory for the company.

- With shortened 3-6 month ramp-up periods, new reps start closing deals and generating revenue much quicker.

- For example, if the average sales cycle is 6 months, a successful LIFOW program could have reps fully productive in just 1-3 months. This accelerates revenue generation by 3+ months.

- For a 10 rep team with $100k average deal sizes, this means $1M in additional revenue in their first year.

Increased Sales Capacity

With compressed ramp times, overall team capacity increases as reps gain productivity faster. The faster reps ramp, the more time they can spend closing deals.

- Deal capacity: The more time each rep spends at full productivity, the more deals they can actively engage with.

- For example, 10 reps ramped in 3 months versus 6 months equates to a 50% capacity boost, allowing pursuit of 50% more leads and 50% more deals.

Enhanced Profits

Faster rep productivity flows more revenue to the bottom line sooner, and cost savings from lower salaries and turnover further increase profit margins.

Competitive Edge

Shorter ramp up gives advantage over competitors still gaining skill.

- Ability to capitalize on opportunities faster seizes market share.

- More skilled reps provide strategic value beyond just order taking

Shortened ramp time drives faster revenue generation, increased sales capacity, and improved profit margins – providing a competitive edge.

Long-Term Implications

Salesforce Scalability

Efficiently scaling a salesforce is pivotal for companies poised for rapid growth. Traditionally, expanding a sales team has been a cautious, deliberate process. Companies often scale their teams slowly to reduce the friction commonly associated with new hire ramp-up periods.

The common wisdom is that smaller new hire cohorts are necessary to minimize ramp-up time. The smaller the cohort, the more resources the company can give, and the faster the new hires will ramp-up. This conventional approach, however, inadvertently shackles revenue growth, as the slow assimilation of new team members can hinder a company’s ability to capitalize on emerging opportunities

Compressed ramp times enable a company to onboard larger cohorts of new hires without the typical dip in productivity. This transformative approach allows the sales organization to scale at a pace previously unattainable. This means the transition to full productivity is significantly shortened. Such dynamism in scaling equips companies to expand their reach and accelerate growth.

Summary

Extended ramp times are a major challenge facing B2B sales organizations today. The average ramp period of 3-6 months before new hires reach full productivity results in substantial costs and revenue losses.

During lengthy ramp cycles, reps are drawing full salaries while contributing little revenue. This strains finances and delays growth. Meanwhile, missed sales opportunities and slower expansion of the salesforce constrain market share gains

Prolonged unproductive periods also risk poor customer interactions that could tarnish the brand. Once ramped up, reps may retain knowledge gaps that hamper sales outcomes.

There is an urgent need for solutions that compress ramp times to minimize lost revenue, curb excessive expenses, and avoid negative buyer experiences. Quickly upskilling reps will realize the full potential of the salesforce faster while seizing markets.

The answer lies in sales enablement tools that embed efficient training within daily workflows. Assistive technologies like Nayak bridge knowledge gaps and equip reps for customer interactions in real-time. Such innovations hold the key to transforming ramp productivity.